When it comes to financial planning, a term insurance plan is one of the most reliable and affordable options available. It is primarily known for offering financial security to your loved ones in case of your untimely demise. However, the best term life insurance in India provides more than just basic life cover—there are several hidden benefits that many people are unaware of.

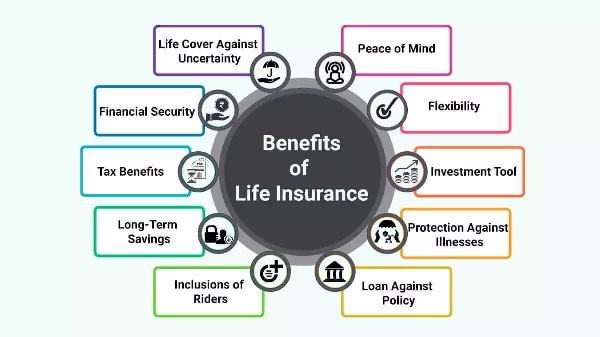

Let’s explore the ten lesser-known advantages of term life insurance plans in India that make them a must-have in your financial portfolio.

Table of Contents

1. Affordable Premiums with High Coverage

A significant hidden advantage of term insurance is its cost-effectiveness. Term plans provide substantial life coverage at a fraction of the cost compared to other insurance products. For instance, a ₹1 crore term insurance policy can cost as little as ₹700-₹1,000 per month for a healthy individual in their 30s.

This affordability allows you to secure your family’s future without straining your budget.

2. Tax Benefits Under Indian Laws

Apart from securing your family’s financial future, term plans also help you save money on taxes:

- Premiums paid are eligible for deductions under Section 80C of the Income Tax Act, up to ₹1.5 lakh annually.

- Death benefits received by the nominee are tax-free under Section 10(10D).

These tax savings make term insurance an excellent investment for both protection and financial planning.

3. Customisable Coverage with Riders

The best term life insurance in India offers optional riders to enhance your coverage. These riders can be added to your policy for a small additional premium:

- Critical Illness Rider: Provides a lump sum in case you’re diagnosed with a critical illness like cancer or heart disease.

- Accidental Death Benefit Rider: Offers an extra payout if death occurs due to an accident.

- Waiver of Premium Rider: Waives future premiums if you’re unable to work due to disability or illness.

Such add-ons ensure you’re covered for unforeseen situations beyond just life cover.

4. Flexible Payout Options

Modern term insurance plans are no longer limited to lump-sum payouts. They offer flexibility in how your nominee receives the sum assured:

- Monthly Income: Ensures a steady flow of income to cover daily expenses.

- Lump Sum + Monthly Income: Combines an upfront payout with regular monthly instalments.

- Increasing Payouts: The payout increases annually to combat inflation.

This flexibility helps your family manage finances more effectively in your absence.

5. Financial Protection for Loans and Debts

If you have outstanding loans like a home loan, car loan, or personal loan, a term plan ensures that these debts don’t become a burden on your family. The payout from the policy can be used to repay these liabilities, allowing your loved ones to remain financially secure.

6. Special Plans for Women

Some insurers offer exclusive benefits for women under term insurance plans. For example:

- Lower premium rates for women due to their longer life expectancy.

- Additional coverage for maternity-related health issues or critical illnesses like breast cancer or cervical cancer.

These features make term plans particularly appealing for women looking to secure their family’s future.

7. Coverage for Terminal Illness

Many term insurance plans in India include coverage for terminal illnesses at no extra cost. If the policyholder is diagnosed with a terminal illness, they can receive the sum assured early to cover medical expenses or other financial needs.

This benefit provides much-needed financial relief during a challenging time.

8. Return of Premium Option

While traditional term plans don’t offer maturity benefits, some insurers now provide a Return of Premium (ROP) option. This feature refunds all the premiums paid if the policyholder survives the policy term.

Although the premiums for ROP plans are slightly higher, they ensure that you get back your investment if you outlive the policy term.

9. Inflation-Proof Coverage

Several term insurance plans offer the option to increase the sum assured periodically to keep up with inflation. This ensures that your family’s financial needs are adequately covered, even as the cost of living rises over time.

For example, a ₹1 crore sum assured can be enhanced by a fixed percentage every year, ensuring the coverage remains relevant.

10. Ease of Buying and Managing Policies Online

The best term life insurance in India now comes with hassle-free online processes. You can:

- Compare multiple plans and premiums online.

- Purchase policies in a matter of minutes without extensive paperwork.

- Manage your policy, pay premiums, or even file claims through digital platforms.

This convenience saves time and ensures a smooth experience throughout the policy tenure.

How to Identify the Best Term Life Insurance in India?

When selecting a term insurance plan, consider the following factors:

- Claim Settlement Ratio (CSR): Choose an insurer with a CSR of over 95% for hassle-free claims.

- Premium Affordability: Ensure the plan fits your budget without compromising on coverage.

- Customisation Options: Look for plans with rider add-ons and flexible payout options.

- Tenure Flexibility: Opt for a policy term that aligns with your financial goals.

The Bottom Line

A term insurance plan is much more than a safety net; it’s a comprehensive financial tool with hidden benefits that go beyond basic life cover. From affordable premiums to inflation-proof coverage and tax savings, the best term life insurance in India ensures that your family is financially secure, no matter what the future holds.

Investing in a term plan today is not just about preparing for uncertainties—it’s about creating a legacy of financial stability and peace of mind. Don’t wait for the perfect time—start exploring your options now and choose a plan that meets your needs.